Credit ratings are opinions about credit risk. Standard & poor ratings express some agency’s opinion about the ability and willingness of an issuer, such as a corporation, state or city government, to meet its financial obligations in full and on time. With credit rating engines, continuous update of their services for the purposes of providing their customers with accurate credit risk estimates is inevitable.

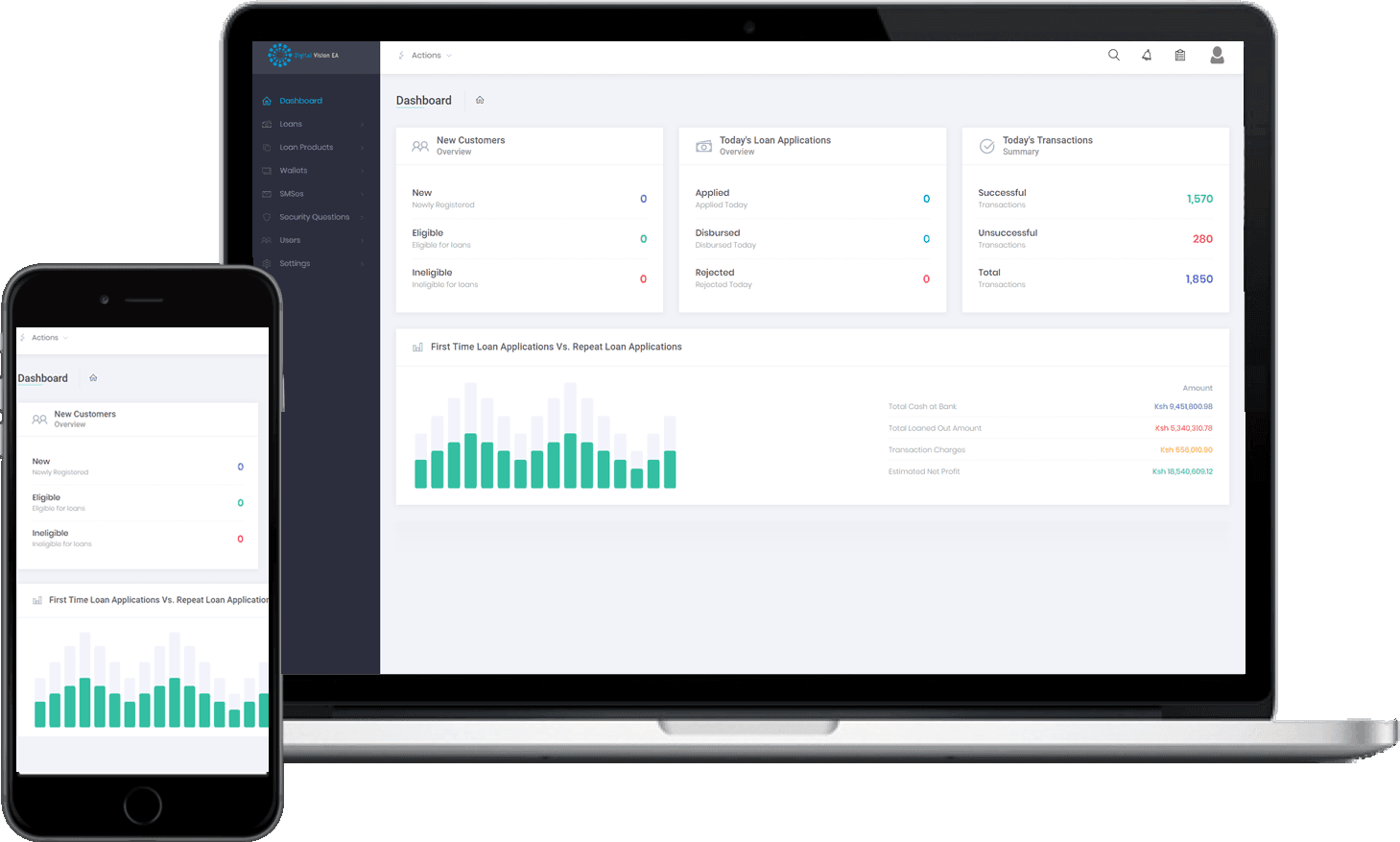

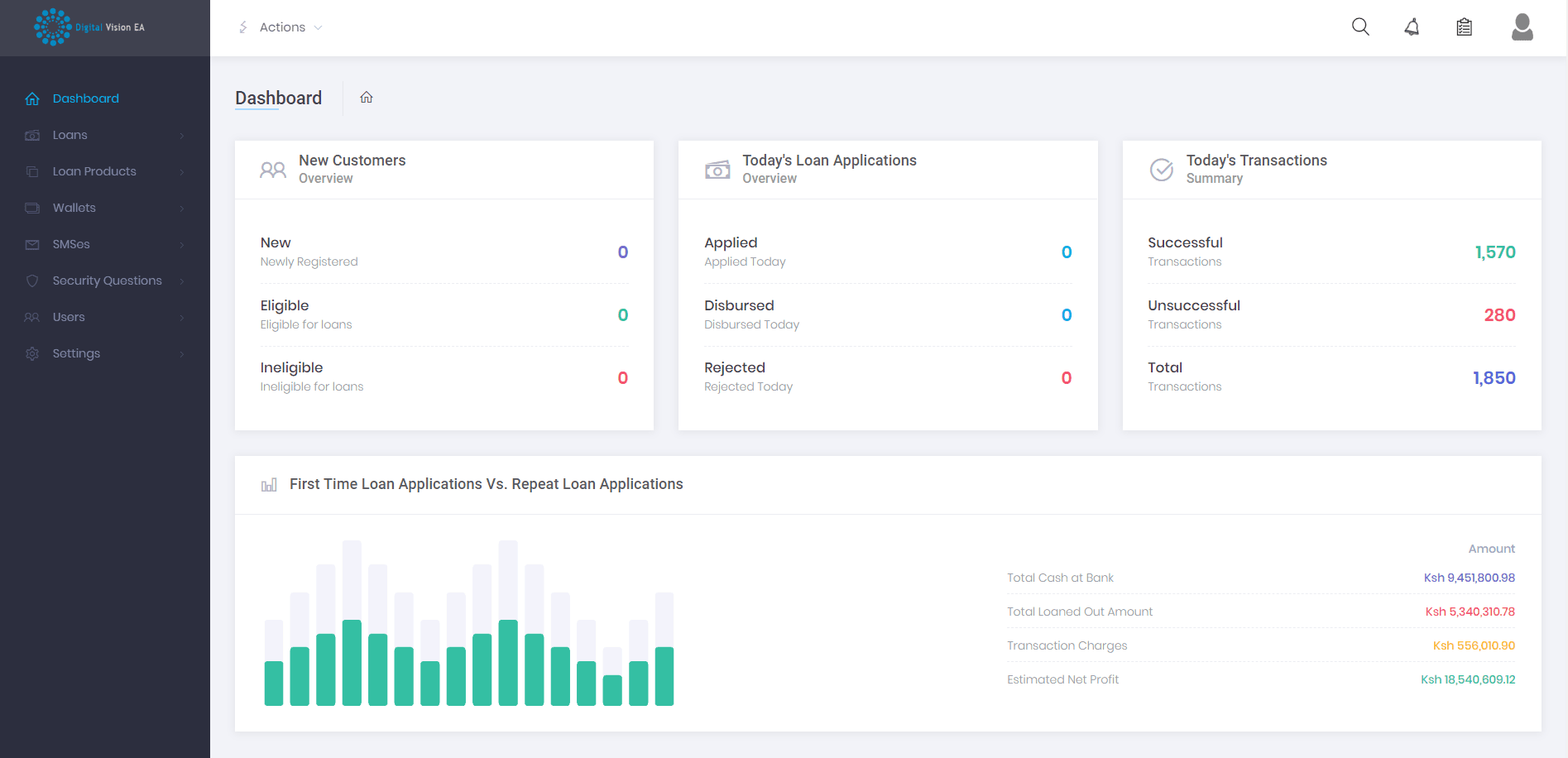

This engine allows automated management of rating acknowledgement processes (i.e. validity terms and checking occasions that require estimate analysis), as well as override request management.

Notable features for the credit rating engine are:

- Provision of performing statistical rating models that can be immediately applied to the various Customer segments.

- Rich user interface including both portfolio views and analyses, as well as summaries of historical and point data of the individual positions.

Request for a project

Talk to us about that idea you are having.

We will work with you all along to transform your idea into an application.